5 Essential Tally Reports for Small Business Owners

In the dynamic landscape of small business operations, staying on top of financial health and performance metrics is crucial for sustained growth and success. Tally, a robust accounting software, has become a go-to solution for small business owners seeking streamlined financial management. In this blog post, we will explore five essential Tally reports that can empower small business owners to make informed decisions, enhance efficiency, and drive profitability.

Balance Sheet Report: Unveiling Financial Health

The balance sheet is a fundamental financial report that provides a snapshot of a company’s financial position at a specific point in time. For small business owners, understanding the balance sheet is paramount in evaluating assets, liabilities, and equity. Tally’s Balance Sheet Report enables users to assess the overall financial health of their business, aiding in strategic planning and resource allocation.

The balance sheet is a fundamental financial report that provides a snapshot of a company’s financial position at a specific point in time. For small business owners, understanding the balance sheet is paramount in evaluating assets, liabilities, and equity. Tally’s Balance Sheet Report enables users to assess the overall financial health of their business, aiding in strategic planning and resource allocation.

Profit and Loss Report: Tracking Revenue and Expenses

For small business owners, keeping a close eye on the bottom line is essential. The Profit and Loss (P&L) Report in Tally allows users to track revenue and expenses over a specific period, providing a comprehensive overview of the company’s financial performance. By analyzing this report, business owners can identify areas of growth, optimize spending, and make informed decisions to enhance profitability.

Cash Flow Statement: Managing Liquidity

Maintaining healthy cash flow is critical for the survival and growth of small businesses. Tally’s Cash Flow Statement Report aids business owners in understanding the movement of cash within their organization. By monitoring cash inflows and outflows, entrepreneurs can  proactively manage liquidity, prevent financial bottlenecks, and ensure the smooth functioning of day-to-day operations.

proactively manage liquidity, prevent financial bottlenecks, and ensure the smooth functioning of day-to-day operations.

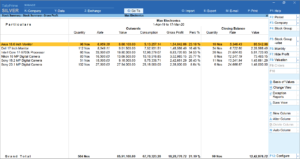

Stock Summary Report: Optimizing Inventory Management

Efficient inventory management is vital for small businesses involved in product-based operations. Tally’s Stock Summary Report provides a comprehensive view of the current stock levels, helping business owners optimize inventory, reduce carrying costs, and prevent stockouts. This report empowers entrepreneurs to make data-driven decisions related to procurement, sales strategies, and overall supply chain management.

Outstanding Receivables and Payables Report: Enhancing Cash Flow

Delayed payments can significantly impact a small business’s cash flow. Tally’s Outstanding Receivables and Payables Report allows business owners to track the amounts owed by customers (receivables) and the amounts owed to suppliers (payables). By staying on top of outstanding payments, small business owners can implement effective credit control measures, negotiate favorable payment terms, and ensure a healthy cash flow.

Conclusion:

In the fast-paced world of small business, leveraging technology to gain actionable insights is crucial for success. Tally, with its array of powerful reporting tools, empowers business owners to navigate financial complexities, make informed decisions, and drive growth. From assessing financial health with the Balance Sheet Report to optimizing inventory management using the Stock Summary Report, Tally’s reports provide a comprehensive view of business operations.

As businesses continue to evolve, the need for customized solutions becomes apparent. RKS, a Tally Customization provider and Tally Data Integrator based in Chennai, India, offers modular, credible, and extremely efficient solutions to clients worldwide. Specializing in ready-to-use standard Tally software such as Tally ERP 9 and Tally Prime, RKS also provides services like Tally customizations, connectivity, data synchronization, and product implementation. By partnering with RKS, small business owners can tailor Tally to suit their unique needs and extract maximum value from this powerful accounting software.