table of contents

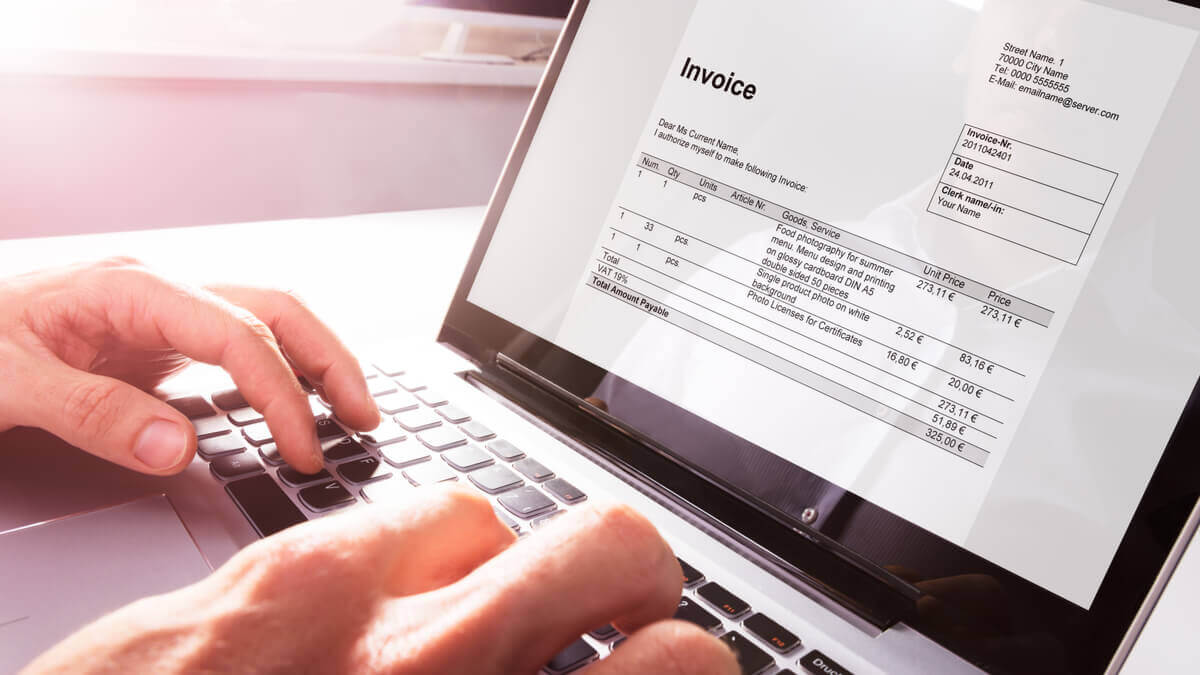

Navigating the intricacies of business transactions unveils a pivotal player—the tax invoice. It’s not just a mundane piece of paperwork; rather, it serves as the backbone of financial dealings, offering a clear snapshot of goods or services exchanged and the accompanying taxes. Whether you’re a seasoned entrepreneur or a budding business owner, mastering the craft of crafting a tax invoice is crucial for compliance and the smooth sailing of financial operations.

Unpacking the Tax Invoice:

At its core, a tax invoice is a seller-issued document to a buyer, meticulously outlining the products or services availed and the corresponding taxes. This document carries legal weight, acting as a transactional record essential for both parties, facilitating tax compliance, aiding in accounting, and bolstering record-keeping practices.

The key elements of a tax invoice encompass:

The key elements of a tax invoice encompass:

- Seller Information: This includes the seller’s name, address, contact details, and tax registration number.

- Buyer Information: Similarly, the buyer’s details—name, address, and contact information—should be prominently featured.

- Invoice Number and Date: Every tax invoice must bear a unique identifier, comprising the invoice number and the issuance date, ensuring accurate transaction tracking.

- Goods or Services Description: An exhaustive list detailing the items or services rendered, complete with quantity, unit price, and the total amount.

- Tax Breakdown: A transparent breakdown of different applicable taxes—like Goods and Services Tax (GST) or Value Added Tax (VAT)—alongside their respective rates.

- Total Amount Payable: The culmination of the net amount for goods or services plus the total taxes, presenting the final payable amount by the buyer.

Crafting a Tax Invoice: The Step-By-Step Guide

Now, let’s dive into the nitty-gritty of creating a tax invoice:

Before diving in, grasp the legal requirements and regulations pertinent to your region. Tax rates, formats, and specific details on the invoice may differ, making staying informed your initial step.

Choose the Right Format:

Opt for a format aligning with your business needs and ensuring compliance with tax regulations—whether it’s manual creation, Excel templates, or dedicated accounting software.

Include Essential Information:

Populate the invoice with all necessary information—seller and buyer details, invoice number, date, itemized list of goods or services, taxes, and the final payable amount.

Invoice Numbering System:

Implement a systematic numbering system to sidestep duplication and enable straightforward tracking, adhering to any regulatory requirements.

Itemize Goods or Services:

Transparently list each item or service along with relevant details—quantity, unit price, and total amount—to facilitate a clear cost breakdown.

Calculate Taxes:

Precisely calculate and clearly state applicable taxes for each item or service, ensuring compliance to dodge legal entanglements.

Total Amount Calculation:

Sum up the net amount and add total taxes to derive the final amount payable by the buyer, prominently displaying it on the invoice.

Review for Accuracy:

Before finalizing, meticulously review the document for accuracy, checking details, calculations, and formatting for precision and professionalism.

Send the Invoice Promptly:

Timely issuance is key for smooth payment processing and record-keeping. Dispatch the invoice promptly to the buyer.

Maintain a Record:

Keep a comprehensive record of all issued tax invoices. This not only aids in compliance but also serves as a valuable resource for financial analysis, audits, and business planning.

Conclusion:

In wrapping up, creating a tax invoice isn’t a mundane task; it’s a meticulous process demanding attention and compliance. It’s not just paperwork—it’s a critical element for financial transparency and accountability in business operations.

For businesses leveraging Tally ERP 9 or Tally Prime, RKS, a Tally Customization provider, and Tally Data Integrator in Chennai, India, offers modular, credible, and efficient solutions. From standard Tally software to customizations, connectivity, data synchronization, and product implementation, they equip businesses with effective financial management.

In the dynamic business realm, mastering the art of crafting tax invoices is pivotal for trust, legal adherence, and seamless financial transactions. By following the outlined step-by-step process, businesses not only meet regulatory requirements but also enhance their overall financial efficiency.

Tally Customisation Provider – RK Solutions

Contact Details

Arcot Rd, Director’s Colony, Kodambakkam,

Chennai, Tamil Nadu 600024

mani[at]tallysoftware.co.in

+91 97894 95540 / +91 97894 95541