table of contents

Navigating the dynamic realms of business and finance demands a keen adherence to ever-changing tax regulations, an integral factor for the prosperity and longevity of any enterprise. The Goods and Services Tax (GST), now implemented in many countries, has added a layer of complexity to tax compliance. In this context, I want to shed light on how Tally, a widely embraced accounting software, serves as a robust tool for simplifying and streamlining the GST compliance journey, ensuring our businesses maintain a favorable standing with tax authorities.

Understanding GST and Its Significance

Before delving into the intricacies of using Tally for GST compliance, let’s grasp the fundamentals of GST and how it influences our day-to-day business operations. GST, a comprehensive indirect tax, is imposed on the supply of goods and services, replacing numerous indirect taxes to introduce uniformity and transparency. However, managing GST compliance necessitates meticulous record-keeping, precise  invoicing, and punctual return filings.

invoicing, and punctual return filings.

Leveraging Tally for Effective GST Compliance

Configuring GST Settings:

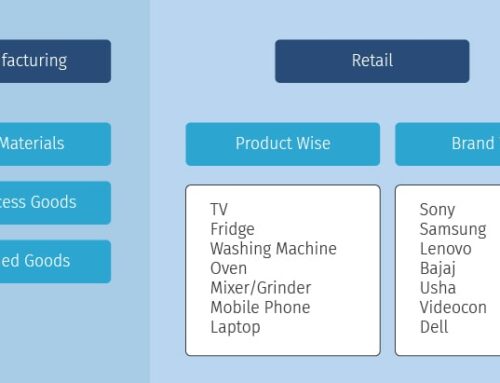

The initial step in utilizing Tally for GST compliance involves configuring the software with the appropriate GST settings. This encompasses setting up GST rates, defining tax classifications for goods and services, and aligning the software with the prevailing GST regulations.

Generating GST-Compliant Invoices:

Tally simplifies the generation of GST-compliant invoices, automating the inclusion of crucial GST details like GSTIN, HSN codes, and applicable tax rates. This not only ensures accuracy but also expedites the invoicing process.

Recording GST Transactions:

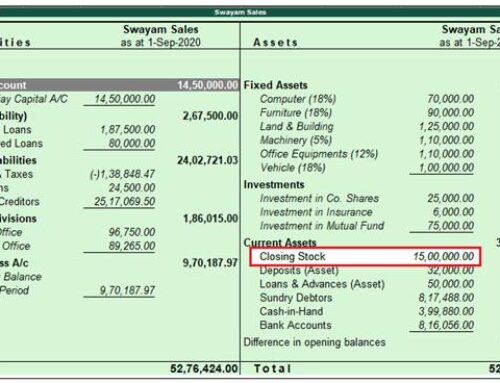

Tally’s user-friendly interface eases the recording of GST transactions. Inputting purchase and sales transactions is a straightforward process, with the software automatically calculating the GST liability. Real-time updates from Tally keep our financial records consistently synchronized with the latest GST regulations.

Filing GST Returns:

Timely filing of returns is a cornerstone of GST compliance, and Tally facilitates this by seamlessly generating GST returns, including GSTR-1, GSTR-3B, and more. The software offers a comprehensive overview of tax liabilities and enables direct filing of returns through the GST  portal.

portal.

Reconciliation and Compliance Reports:

Tally’s robust reconciliation features enable us to align our books with data from the GST portal. Additionally, the software generates compliance reports, providing a clear snapshot of our GST compliance status. This not only aids internal audits but also ensures preparedness for external audits by tax authorities.

In Conclusion

In conclusion, utilizing Tally for GST compliance transcends mere convenience; it is a strategic necessity for businesses operating in a GST-regulated environment. From configuring GST settings to generating compliant invoices, recording transactions, and filing returns, Tally streamlines the entire GST compliance process. Its user-friendly interface and automation features make it an invaluable asset for businesses of all sizes.

For those seeking enhanced customization and integration capabilities with Tally, partnering with RKS proves to be a reliable choice. As a Tally Customization provider and Tally Data Integrator based in Chennai, India, RKS offers modular, credible, and highly efficient solutions. Specializing in Tally ERP 9 and Tally Prime, RKS supports ready-to-use standard Tally software and provides services such as Tally customizations, connectivity, data synchronization, and product implementation. By choosing RKS, businesses can elevate their Tally experience and ensure seamless GST compliance with tailored solutions.

In a world where regulatory compliance is non-negotiable, mastering the use of Tally for GST compliance becomes a strategic imperative for businesses aiming for sustained growth and success.

Tally Customisation Provider – RK Solutions

Contact Details

Arcot Rd, Director’s Colony, Kodambakkam,

Chennai, Tamil Nadu 600024

mani[at]tallysoftware.co.in

+91 97894 95540 / +91 97894 95541